What is GRC?

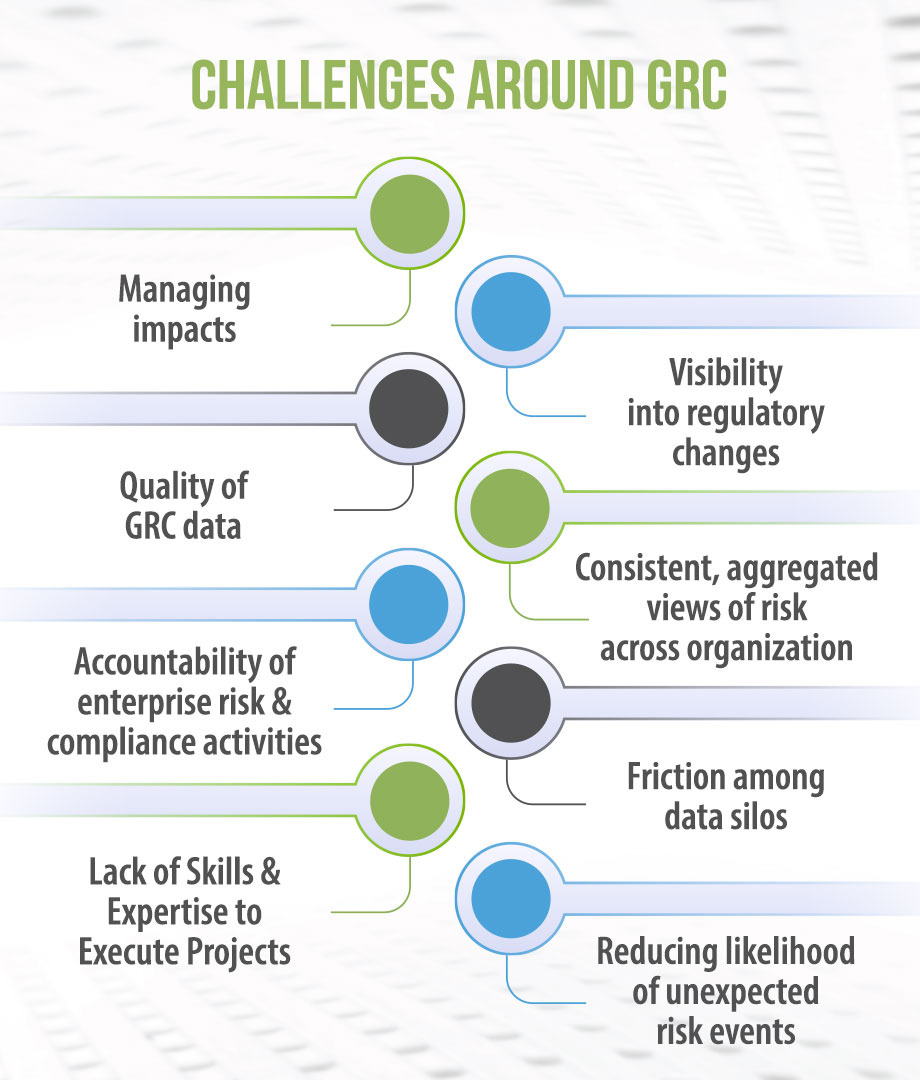

GRC (governance, risk & compliance) is an organizational strategy for managing governance, risk management, and compliance with regulations. It includes software capabilities for implementing and managing an enterprise GRC program. GRC helps companies align IT with business objectives, manage risks, reduce costs, and meet compliance requirements. It improves decision-making and performance through an integrated view of risk management.

- IBM OpenPages

- ServiceNow GRC

IBM OpenPages

Is an AI-driven governance, risk and compliance (GRC) platform. Built to help organizations manage risk and regulatory compliance challenges. Using AI capabilities from IBM Watson®, the OpenPages platform consolidates disparate GRC systems and centralizes siloed risk management functions in one integrated solution. This helps reduce the cost of maintaining multiple solutions.

Overview of Services Offered

- Findability Sciences helps clients optimize their use of GRC platforms such as IBM® OpenPages, Servicenow, and MetricStream by supplementing them with proprietary tools for NLP and Predictive AI (Findability.AI), and the trademarked CUPPTM

- Clients can maintain better quality of data by leveraging the Wide Data framework, resulting in better predictability of the risk and compliance reporting.

- Our skilled team of GRC experts are trained and certified in the use of third-party products such as IBM® OpenPages and Servicenow. Their strong background in data science, automation and analytics helps our clients implement and deliver GRC solutions on time and delivering measurable business Outcomes.

- Findability Sciences works both with pre-configured GRC systems and provide customized integration services for third-party applications.

- We help clients automate dashboards and reports in their GRC application of choice.

- Clients can also benefit from testing and performance monitoring services for their GRC installations. Our custom-built, conversational AI based regulatory reporting can simplify the reviewing of GRC data by leadership.

ServiceNow GRC

ServiceNow Governance, Risk, and Compliance (GRC) helps transform inefficient processes across your extended enterprise into an integrated risk program. Through continuous monitoring and automation ServiceNow delivers a real-time view of compliance and risk, improves decision making, and increases performance across your organization and with vendors. Only ServiceNow can connect the business, security, and IT with an integrated risk framework that transforms manual, siloed, and inefficient processes into a unified program built on a single platform.

Overview of Services Offered

- Findability Sciences helps clients optimize their use of GRC platforms such as IBM® OpenPages, Servicenow, and MetricStream by supplementing them with proprietary tools for NLP and Predictive AI (Findability.AI), and the trademarked CUPPTM

- Clients can maintain better quality of data by leveraging the Wide Data framework, resulting in better predictability of the risk and compliance reporting.

- Our skilled team of GRC experts are trained and certified in the use of third-party products such as IBM® OpenPages and Servicenow. Their strong background in data science, automation and analytics helps our clients implement and deliver GRC solutions on time and delivering measurable business Outcomes.

- Findability Sciences works both with pre-configured GRC systems and provide customized integration services for third-party applications.

- We help clients automate dashboards and reports in their GRC application of choice.

- Clients can also benefit from testing and performance monitoring services for their GRC installations. Our custom-built, conversational AI based regulatory reporting can simplify the reviewing of GRC data by leadership.

Is an AI-driven governance, risk and compliance (GRC) platform. Built to help organizations manage risk and regulatory compliance challenges. Using AI capabilities from IBM Watson®, the OpenPages platform consolidates disparate GRC systems and centralizes siloed risk management functions in one integrated solution. This helps reduce the cost of maintaining multiple solutions.

Overview of Services Offered

- Findability Sciences helps clients optimize their use of GRC platforms such as IBM® OpenPages, Servicenow, and MetricStream by supplementing them with proprietary tools for NLP and Predictive AI (Findability.AI), and the trademarked CUPPTM

- Clients can maintain better quality of data by leveraging the Wide Data framework, resulting in better predictability of the risk and compliance reporting.

- Our skilled team of GRC experts are trained and certified in the use of third-party products such as IBM® OpenPages and Servicenow. Their strong background in data science, automation and analytics helps our clients implement and deliver GRC solutions on time and delivering measurable business Outcomes.

- Findability Sciences works both with pre-configured GRC systems and provide customized integration services for third-party applications.

- We help clients automate dashboards and reports in their GRC application of choice.

- Clients can also benefit from testing and performance monitoring services for their GRC installations. Our custom-built, conversational AI based regulatory reporting can simplify the reviewing of GRC data by leadership.

Success Stories

THE PROBLEM

The problem faced by the company is the need to launch a $250Bn start-up with a small team, while also ensuring that essential IT and key business functions are up and running quickly. This can be challenging as it requires the company to find ways to efficiently and effectively manage resources and streamline processes to achieve their objectives within a limited timeframe.

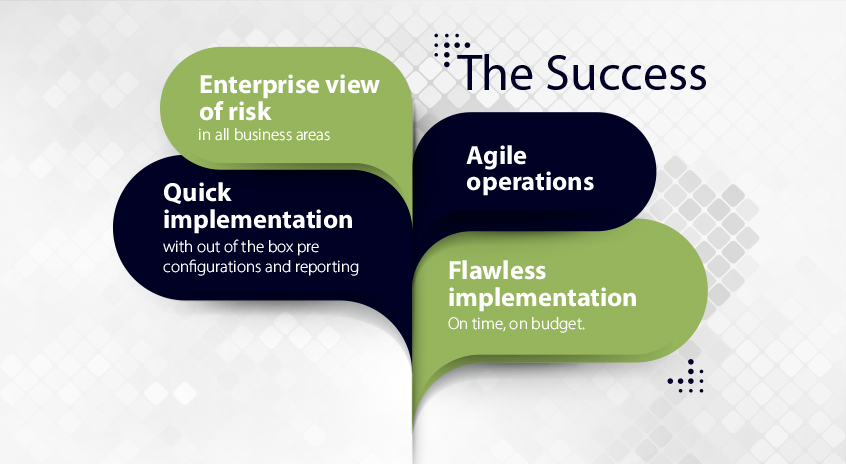

THE SOLUTION

Findability AI offers a comprehensive solution for risk and compliance management. Access all eight OpenPages modules seamlessly on the cloud and streamline your business operations with ease.

Success Stories

THE PROBLEM

• Risk and compliance operations were managed via spreadsheets and manual reporting

• Lacked timely response to the business and regulators

• Needed risk visibility and compliance to international standards

THE SOLUTION

• Findability AI provides an effective solution for risk and compliance management with access to seven OpenPages modules. Simplify your business processes and stay compliant with ease using our solution.

Success Stories

THE PROBLEM

• An aging internal control management system – not user friendly , nor intuitive

• Needed to support a 3-lines of defense, risk management program

THE SOLUTION

• Achieve seamless risk and compliance management with Findability AI’s solution. Access the OpRisk, Policy & Compliance, and Event Entry modules on the cloud, making it easier to streamline operations and stay compliant.

Success Stories

THE PROBLEM

The company faced a challenge after being hit with a regulatory fine due to their ineffective OpRisk framework. It highlights the importance of having robust risk management protocols to avoid penalties and potential business disruptions.

THE SOLUTION

Findability AI offers a powerful risk management solution, featuring OpenPages OpRisk and Model Risk Governance modules. Ensure compliance and streamline your operations with our comprehensive solution.

Success Stories

THE PROBLEM

• Current risk operations were managed via spreadsheets, with

reports created manually.

• Lack of timely response to the business and regulators, nor had a

total view of risk exposure across the enterprise.

THE SOLUTION

• Findability AI resolved compliance challenges with their OpenPages solution, featuring OpRisk and Policy & Compliance modules accessible on the cloud.

Success Stories

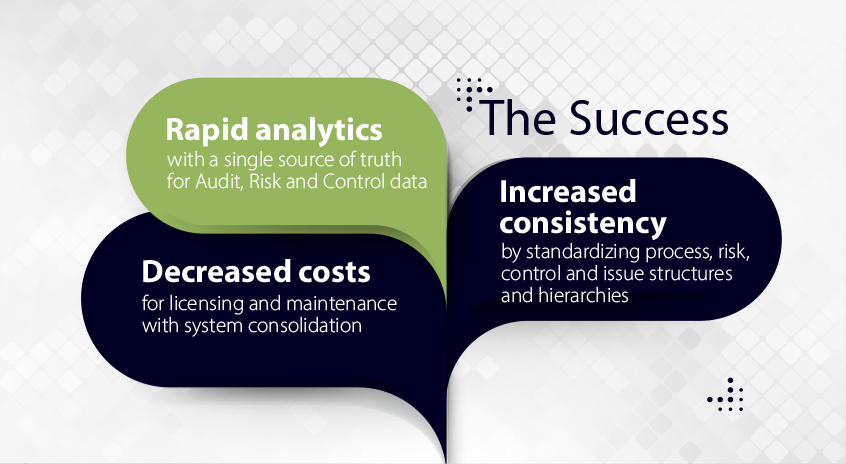

• Relied on four separate systems to support its Audit, Risk and Control activities

• No real-time view of relationships between risks, controls and issues across the company

THE SOLUTION

• Findability AI offers OpenPages as a solution to effectively manage Audit, Risk, and Control landscapes. Achieve efficient and compliant operations with our comprehensive solution.

ServiceNow Governance, Risk, and Compliance (GRC) helps transform inefficient processes across your extended enterprise into an integrated risk program. Through continuous monitoring and automation ServiceNow delivers a real-time view of compliance and risk, improves decision making, and increases performance across your organization and with vendors. Only ServiceNow can connect the business, security, and IT with an integrated risk framework that transforms manual, siloed, and inefficient processes into a unified program built on a single platform.

Overview of Services Offered

- Findability Sciences helps clients optimize their use of GRC platforms such as IBM® OpenPages, Servicenow, and MetricStream by supplementing them with proprietary tools for NLP and Predictive AI (Findability.AI), and the trademarked CUPPTM

- Clients can maintain better quality of data by leveraging the Wide Data framework, resulting in better predictability of the risk and compliance reporting.

- Our skilled team of GRC experts are trained and certified in the use of third-party products such as IBM® OpenPages and Servicenow. Their strong background in data science, automation and analytics helps our clients implement and deliver GRC solutions on time and delivering measurable business Outcomes.

- Findability Sciences works both with pre-configured GRC systems and provide customized integration services for third-party applications.

- We help clients automate dashboards and reports in their GRC application of choice.

- Clients can also benefit from testing and performance monitoring services for their GRC installations. Our custom-built, conversational AI based regulatory reporting can simplify the reviewing of GRC data by leadership.

Srini "Balaji" Krishnamoorthy

Sr VP- AI Services

Balaji believes that applying the power of AI is key to staying ahead in today's fast-paced business landscape. He is the Head of Findability Labs, a leading provider of AI-powered solutions for businesses. With his extensive experience in the Fintech industry, Balaji specializes in using predictive and prescriptive analytics to solve complex business challenges and drive significant financial returns for global organizations.

Set up a Call with Balaji